Written by: Bojan Pravica, founder of Elementum

China is today one of the key forces of the global economy, but when it comes to one of the most important monetary topics – the amount of gold in its state reserves – it remains surprisingly reserved. Official data on the gold reserves of the People’s Bank of China change rarely, gradually, and in small steps. Compared to other major central banks, the level of transparency is low.

This raises a question that has been stirring the imagination of analysts, economists, and investors for several years: do the officially published numbers actually reflect the real situation, or are they just part of a wider, deliberate strategy of non-transparency? And even more importantly – why would China want to conceal the extent of its gold reserves at all?

What China officially reports

According to official data from the People’s Bank of China, the country’s gold reserves are relatively stable and represent a relatively small share of total foreign exchange reserves. Changes are usually announced with a delay and to a limited extent, often without additional explanation or context.

This method of reporting stands in sharp contrast to the scale of the Chinese economy, the size of its foreign exchange reserves, and the role it plays in global trade. This discrepancy alone raises doubt whether the official numbers tell the whole story.

It is not only important what China reports, but how. Data on gold is not updated regularly, monthly or quarterly, as with some other central banks. Instead, it appears in batches, sometimes after several years of relative silence.

In the world of monetary policy, such uneven communication is usually not accidental. Central banks understand well that data affects market expectations. Silence is often a form of narrative control.

When analysts look at the broader picture – physical gold flows, import data, and domestic market operations – questions begin to arise. China is one of the world’s largest gold producers and simultaneously one of the largest importers.

A large part of this gold remains within the country. It is not exported further but absorbed into the domestic system. This in itself does not prove that the gold ends up in state reserves, but it opens space for alternative interpretations.

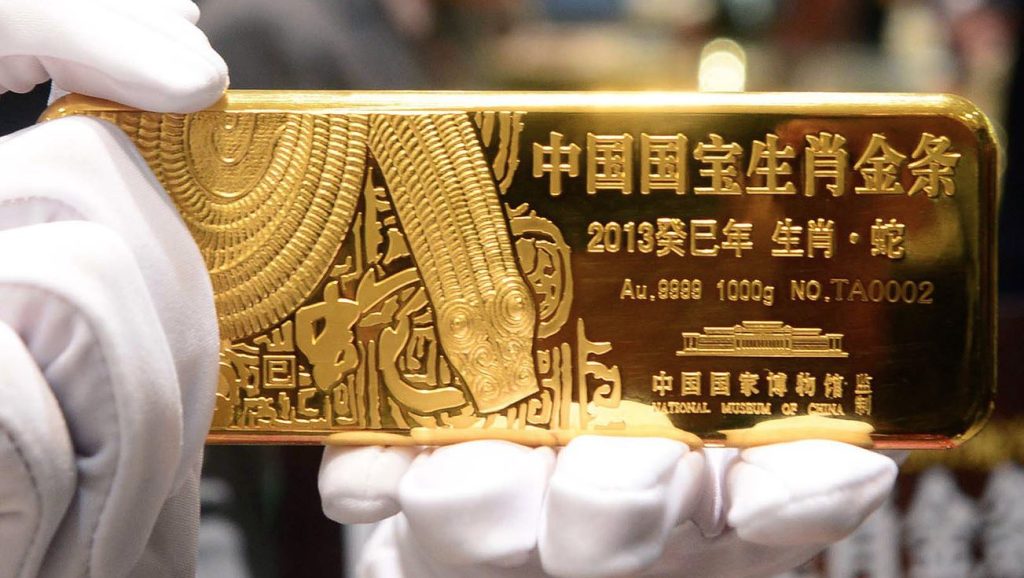

The Shanghai Gold Exchange plays a key role in China’s precious metals distribution system. It is a regulated market working in close cooperation with state institutions. As a rule, all imported quantities of gold must pass through this system.

This means the state has a good overview of the entire flow of gold within its borders. The difference between what enters the system and what appears in official reserves is therefore all the more interesting.

State and quasi-state actors

One of the reasons why it is difficult to accurately estimate Chinese gold reserves is the distinction between formal central bank ownership and ownership by other state or quasi-state institutions.

Gold can be:

- on the central bank's balance sheet,

- owned by sovereign wealth funds,

- in the reserves of state-owned banks,

- or in strategic stockpiles not part of classic forex reserves.

This dispersion allows flexibility and simultaneously makes external assessment difficult.

Why estimates are so different

The reason for large differences between estimates is not necessarily the inaccuracy of analyses, but the lack of a reference point. When a state consciously limits transparency, the range of possible interpretations naturally expands.

However, it is significant that several independent analyses using different methodologies often converge on similar conclusions: official numbers are likely the lower bound, not the full picture.

Historical parallel: The Soviet Union

History offers an interesting parallel. The Soviet Union also systematically accumulated gold during the Cold War, while the West had no real idea of the actual scale of these reserves for decades. The truth became known only much later, with the opening of archives.

Monetary non-transparency is not an anomaly, but an established element of strategic thinking by great powers.

Why China has no interest in revealing the truth

Revealing actual gold reserves would have several consequences:

- it would impact the price of gold,

- it would change the perception of the yuan,

- it would increase geopolitical pressure,

- and reduce maneuvering space in future negotiations.

From the perspective of Chinese interests, it is therefore rational to maintain strategic ambiguity.

Gold in Chinese strategy is not intended for day-to-day monetary policy. It represents long-term insurance and potential support for a greater role of the yuan in the future.

This does not mean direct gold backing, but greater credibility in a world where trust in fiat currencies is no longer taken for granted.

Contrary to the Western understanding of transparency as an absolute value, in some contexts ambiguity is a form of power. If markets and competitors do not know exactly what you possess, it is harder for them to formulate a strategy against you.

China uses this logic consistently.

What disclosure would mean for markets

If China were to suddenly reveal significantly larger gold reserves, it would likely trigger:

- a revaluation of gold,

- increased interest in alternative reserve strategies,

- and further debate on the future role of the dollar.

Precisely for this reason, it is likely that such a disclosure will not happen suddenly, but gradually – or only in a completely different monetary context.

What we can conclude today

Although we do not have complete data, we can conclude a few key things:

- China is systematically accumulating gold,

- it does so long-term and with discipline,

- and views it as a strategic element, not a market investment.

This is enough to understand the direction, even if the exact numbers remain unknown.

Conclusion

The question of how much gold China really has may never get a clear, unambiguous answer. But paradoxically, that is not even the most important thing.

It is more important to understand why China acts the way it does. Its approach reveals a deep awareness that the global monetary system is changing – and that in the future, what will have the greatest value is not that which depends on promises, but on actual control over assets.

In the next article, we will broaden the perspective and look at how, simultaneously with the growth of gold reserves, the share of the dollar in global foreign exchange reserves is gradually decreasing and why this data is key to understanding the future of global money.